Alternatively you may launch this applet using Java WebStart. Minimum requirements: Java 1.6. Tested with Firefox and Safari. Source code for the underlying library is available at finmath.net.

IMPORTANT: The applet is currently self-signed. Hence it will no longer run under the Java security level "high", which has become default. In order to run the applet, you need to add the domain http://christian-fries.de to the Exception Site List. To edit the Exception Site List open the Java control panel, select the Security tab, then press Edit Site List.

This tools illustrated Bermudan option pricing using Monte Carlo simulation.

It serves as a companion to Chapter 15 of Mathematical Finance.

Upon each exercise date T1, T2,...,Tn the holder of the Bermudan has the right to either exercise and receive Ni * (S(Ti) - Ki) or receive a shorter Bermudan option on the remaining exercises Tj > Ti. The last option pays either Nn * (S(Tn) - Kn) or nothing. Setting notional negative will give you a put instead of a call.

Various methods to estimate the exercise boundary are implemented:

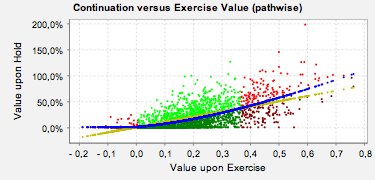

The exercise boundary is visualized in a scatter plot, see Figure 1. The picture shows the situation at a specific exercise date. Each dot represents the value upon hold depending on the value upon exercise for a specific simulation path. The conditional expectation is shown as a function of the value upon exercise (blue line). The exercise region (green) is defined as the paths having exercise values (yellow line) above the expected value upon hold (blue line).

© Copyright 2007,2013 Christian P. Fries