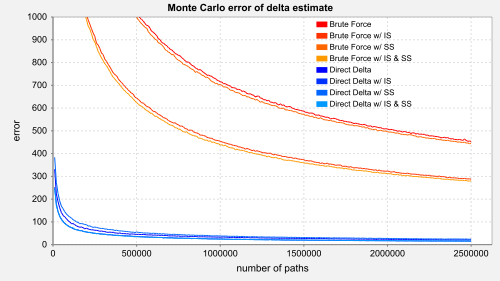

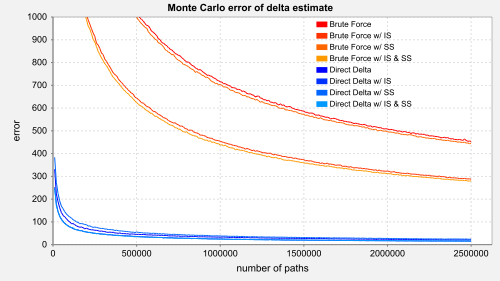

Convergence rate of CDO delta for standard finite differences (aka. brute force) with different variance reduction techniques [red] and the method using the conditional cumulative default time distribution (aka. direct delta) [blue].

Rott, Marius G.; Fries, Christian P.: Fast and Robust Monte Carlo CDO Sensitivities and their Efficient Object Oriented Implementation. Version 0.9.2. May 31, 2005. [602 KB] - Download from DefaultRisk.com.

The method we propose in this paper is generic and allows for an equally generic object oriented implementation which is highly efficient with respect to calculation performance and coding time (time to market). We present the design pattern of a stochastic iterator, the default time iterator, to create a highly flexible product implementation framework in which any product may become the underlying of any other product. Our benchmark calculations indicate that our method improves calculation time by a factor of around 1000 compared to brute force finite differences. The coding of a new product still remains on a "plug-and-play" level with very short development time.

JEL Class: C63, G13