Partial Proxy Simulation Schemes for Robust Monte-Carlo Sensitivities

30. 09 06 - 23:33 - Category:Mathematics

(English Text) | Research

(English Text)

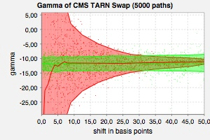

As a benchmark we apply the method to the pricing of digital caplets and target redemption notes using LIBOR and CMS indices under a LIBOR Market Model. We calculate stable deltas, gammas and vegas by applying direct finite difference to the proxy simulation scheme pricing.

The framework is generic in the sense that it is model and almost product independent. The only product dependent part is the specification of the proxy constraint. This allows for an elegant implementation, where new products may be included at small additional costs.

For more information see http://www.christian-fries.de/finmath/proxyscheme.