Mathematics (English Text)

Monte-Carlo Methods on GPGPU with Applications to Mathematical Finance

19. 09 13 - 14:18 -

There will be a workshop on

Monte-Carlo Methods on GPGPU with Applications to Mathematical Finance

at the LMU quantLab. For details see http://www.fm.mathematik.uni-muenchen.de/news/gpu_workshop_news/index.html

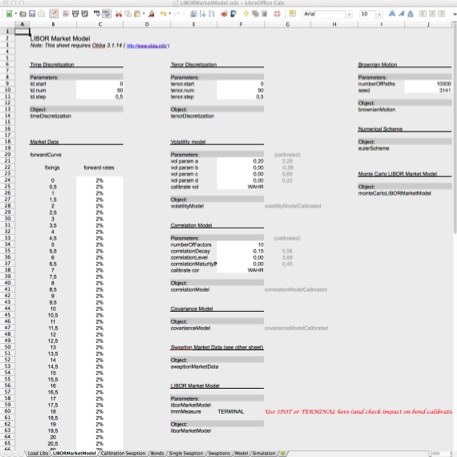

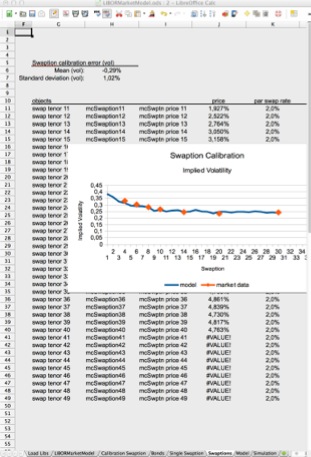

LIBOR Market Model: Spreadsheet and Source Code

07. 03 13 - 19:28 -

Spreadsheet and code for the LIBOR market model added to finmath.net. Java source code availabe from the finmath lib subversion repository.

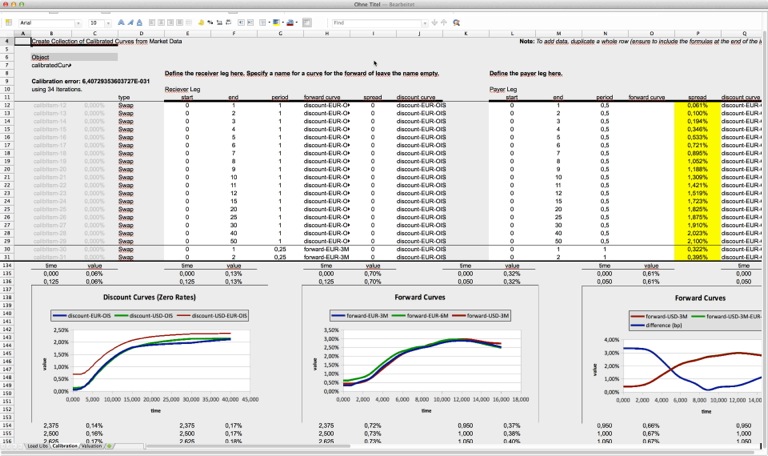

Curve Calibration: Spreadsheet and Source Code

31. 12 12 - 17:38 -

Demo spreadsheet for the calibration of curves (discount curves, forward curves) to interest rate swaps added to the spreadsheets section of finmath.net. Java source code availabe from the finmath lib subversion repository.

Computational Finance: Job Offer at LMU Department of Mathematics

07. 08 12 - 23:30 -

The

Ludwig-Maximilian-University Munich, Department of

Mathematics, is advertising a

Post Doctoral or Doctoral position

in the

field of financial and insurance mathematics

with special IT duties. The

position is commencing at the earliest convenience

for a term of 2 years with possible extension.

For details see http://www.christian-fries.de/lmu/joboffer2012

Conditional Analytic Monte-Carlo Pricing Scheme for Auto-Callables

27. 04 08 - 23:43 -

We renamed the paper cited in the Journal of

Computational Finance 11(3) as "A semi-analytic

Monte Carlo pricing scheme for auto-callable

products". Its new title is "Conditional Analytic Monte Carlo

Pricing Scheme for Auto-Callable

Products".

Book: Mathematical Finance: Second Printing

08. 04 08 - 15:56 -

Wiley released a second printing of my book.

The second printing is based on Version 1.6.11 of the

PDF file. It thus contains many of the error

corrections listed on the errata page. In addition, I

rewrote a few sections (25 pages changed), but

the difference to the old version is still

minor. Major improvements, like new sections

will be posted to the book's update page. (The version

number is printed on page v).

PS: I will donate a larger part of my 2007 net revenue to charity organizations (like the Fördergemeinschaft Deutsche Kinderherzzentren and Deutsche Krebshilfe (German Cancer Aid)). However: my net revenue is comparably small. From Wiley I get approximately $3 per book. BTW: Sorry for the price tag. I wasn't aware that the author does not have any influence on the pricing of his book.

PS: I will donate a larger part of my 2007 net revenue to charity organizations (like the Fördergemeinschaft Deutsche Kinderherzzentren and Deutsche Krebshilfe (German Cancer Aid)). However: my net revenue is comparably small. From Wiley I get approximately $3 per book. BTW: Sorry for the price tag. I wasn't aware that the author does not have any influence on the pricing of his book.

Sample Chapters

05. 02 08 - 20:52 -

Sample chapters for "Mathematical Finance" are

available as a free download from the book's homepage.

Joshi on LMM

21. 10 07 - 23:37 -

Mark Joshi is giving a seminar on "Implementing the

LIBOR Market Model". The seminar will take place in

London, 24th-25th January 2008. For more information

see the flyer. Literature: Mark's

books at amzon.co.uk, amzon.com, amazon.de.

Mathematical Finance: Picture Book

18. 08 07 - 23:01 -

The "Mathematical Finance Picture

Book" presents some aspects of mathematical

finance in pictures. It is a companion to

"Mathematical Finance: Theory, Modeling,

Implementation" (which contains these figures in

grayscale only).

The "Mathematical Finance Picture Book" is available as PDF.

The "Mathematical Finance Picture Book" is available as PDF.

Book: Mathematical Finance: Theory, Modeling, Implementation: Errata

18. 08 07 - 22:08 -

Version 1.5 of "Mathematical Finance" is

published by Wiley on August 24th. I will

maintain an errata online at www.christian-fries.de/finmath/book/errata.

Book: Mathematical Finance: Theory, Modeling, Implementation

31. 03 07 - 00:51 -

Version 1.5 of my book may be pre-ordered at

Amazon™:

Mathematical Finance Lecture Notes

21. 01 07 - 23:58 -

The translation of

my lecture notes on "mathematical finance" has been

completed. The manuscript still needs some

proofreading and polishing. If you would like to do a

payed proofreading job on the manuscript please

contract me via email (a native english speaker with

good knowledge of german and some knowledge of math

would be an ideal candidate).

I have released version 1.4 of the manuscript (in both german and english).

For a detailed table of contents see http://www.christian-fries.de/finmath/book.

I have released version 1.4 of the manuscript (in both german and english).

For a detailed table of contents see http://www.christian-fries.de/finmath/book.

Talk on Proxy Simulation Scheme Method

01. 10 06 - 20:16 -

I gave a talk at

the WBS 3rd Fixed Income Conference, Amsterdam, 21-22

September 2006 presenting the proxy simulation scheme

method. The talk covered the "full proxy" and the

"partial proxy" simulation scheme method. The first

part (full proxy) had been presented at the

Quantitative Methods in Finance Conference, Sydney,

2005. I have posted an updated version of the slides

at www.christian-fries.de/finmath/talks/2006proxyScheme

In addition I gave a 10 min talk at the "interest rate plenary panel". If you are interest in the "foresight bias correction" mentioned there, see www.christian-fries.de/finmath/foresightbias.

In addition I gave a 10 min talk at the "interest rate plenary panel". If you are interest in the "foresight bias correction" mentioned there, see www.christian-fries.de/finmath/foresightbias.

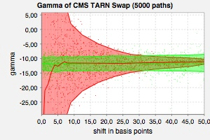

Partial Proxy Simulation Schemes for Robust Monte-Carlo Sensitivities

30. 09 06 - 23:33 -

As a benchmark we apply the method to the pricing of digital caplets and target redemption notes using LIBOR and CMS indices under a LIBOR Market Model. We calculate stable deltas, gammas and vegas by applying direct finite difference to the proxy simulation scheme pricing.

The framework is generic in the sense that it is model and almost product independent. The only product dependent part is the specification of the proxy constraint. This allows for an elegant implementation, where new products may be included at small additional costs.

For more information see http://www.christian-fries.de/finmath/proxyscheme.

Mathematical Finance Lecture Notes

29. 09 06 - 22:18 -

Version 1.3.x of

the lecture notes on "mathematical finance" now

contains the missing chapter on Monte-Carlo

sensitivities. The calculation of Monte-Carlo

sensitivities (a.k.a. Greeks) was discussed in the

last two sessions of the 2005/2006 lecture. Apart

from two new chapters this version contains over 100

corrections.

For a detailed table of contents see http://www.christian-fries.de/finmath/book.

For a detailed table of contents see http://www.christian-fries.de/finmath/book.

Cross-Currency Markov Functional Model with FX Smile

15. 08 06 - 09:03 -

We have a

paper on the cross-currency Markov

functional model where the FX functional allow a

calibration to a given market implied volatility

smile. Calibration works for twenty years and

beyond. More details may be found in the Diploma

thesis of Fabian Eckstädt.

One Day Lecture at s:f:i

23. 07 06 - 23:47 -

The lecture will take place August 2nd at University of Lausanne. See the program of this event for details. As precourse reading you should consider Chapter 8, 9 and 10 (interest rate basics), Chapter 12 (exotic derivatives) and Chapter 15 (libor market model) of my lecture notes. These chapters are available in english and german.

Foresight Bias

14. 07 06 - 22:45 -

Mathematical Finance Lecture Notes

12. 05 06 - 12:53 -

A first draft of

the english version of "Mathematical Finance"

is available on my home

page.

Chapters which are not yet translated will be

given in German. I will add more translations

depending on my spare time.

The book arose from my lecture notes for the lectures on mathematical finance held at University of Mainz and University of Frankfurt. It tries to give a balanced representation of the theoretic foundations, state of the art models, which are actually used in practice and their implementation.

For more information see http://www.christian-fries.de/finmath/book.

The book arose from my lecture notes for the lectures on mathematical finance held at University of Mainz and University of Frankfurt. It tries to give a balanced representation of the theoretic foundations, state of the art models, which are actually used in practice and their implementation.

For more information see http://www.christian-fries.de/finmath/book.

Equity Markov Functional Model

02. 04 06 - 10:24 -

Version 0.4 of the paper is still lacking an introduction.

(Edit 14.04.06): In Version 0.8 I have added a nice discussion on model dynamics, using Black-Scholes like functionals as a starting point for my examples. The discussion shows how to calibrate the joint asset-interest rate dynamics (ie. r(S)) and forward volatility (all this in addition to the calibration to a full two dimensional smile surface.

Smile Modeling in the LIBOR Market Model

24. 02 06 - 00:10 -

I have put online the Diploma thesis of Markus

Meister "Smile Modeling in the LIBOR Market Model".

See http://www.christian-fries.de/finmath.