Research (English Text)

Conditional Analytic Monte-Carlo Pricing Scheme for Auto-Callables

27. 04 08 - 23:43 -

We renamed the paper cited in the Journal of

Computational Finance 11(3) as "A semi-analytic

Monte Carlo pricing scheme for auto-callable

products". Its new title is "Conditional Analytic Monte Carlo

Pricing Scheme for Auto-Callable

Products".

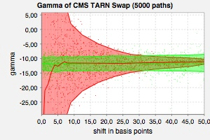

Partial Proxy Simulation Schemes for Robust Monte-Carlo Sensitivities

30. 09 06 - 23:33 -

As a benchmark we apply the method to the pricing of digital caplets and target redemption notes using LIBOR and CMS indices under a LIBOR Market Model. We calculate stable deltas, gammas and vegas by applying direct finite difference to the proxy simulation scheme pricing.

The framework is generic in the sense that it is model and almost product independent. The only product dependent part is the specification of the proxy constraint. This allows for an elegant implementation, where new products may be included at small additional costs.

For more information see http://www.christian-fries.de/finmath/proxyscheme.

Equity Markov Functional Model

02. 04 06 - 10:24 -

Version 0.4 of the paper is still lacking an introduction.

(Edit 14.04.06): In Version 0.8 I have added a nice discussion on model dynamics, using Black-Scholes like functionals as a starting point for my examples. The discussion shows how to calibrate the joint asset-interest rate dynamics (ie. r(S)) and forward volatility (all this in addition to the calibration to a full two dimensional smile surface.